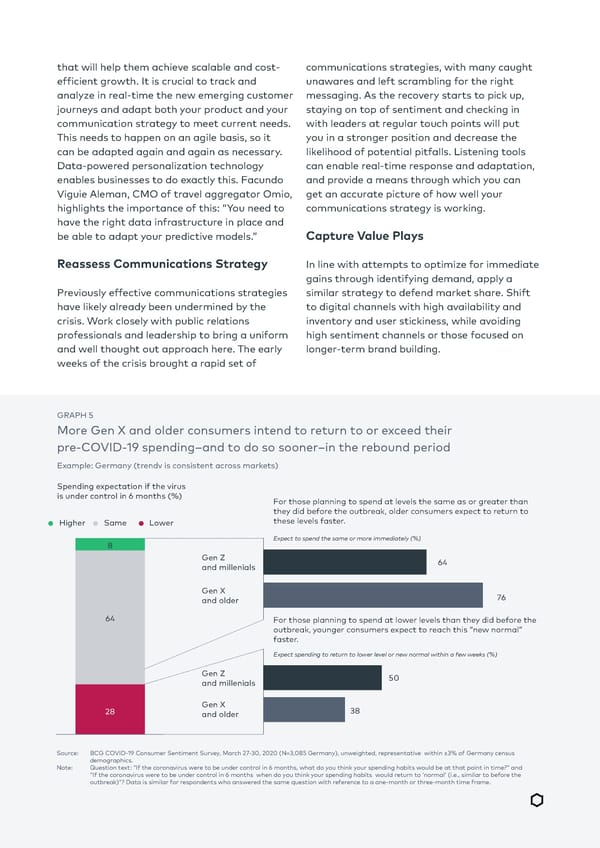

that will help them achieve scalable and cost- communications strategies, with many caught efficient growth. It is crucial to track and unawares and left scrambling for the right analyze in real-time the new emerging customer messaging. As the recovery starts to pick up, journeys and adapt both your product and your staying on top of sentiment and checking in communication strategy to meet current needs. with leaders at regular touch points will put This needs to happen on an agile basis, so it you in a stronger position and decrease the can be adapted again and again as necessary. likelihood of potential pitfalls. Listening tools Data-powered personalization technology can enable real-time response and adaptation, enables businesses to do exactly this. Facundo and provide a means through which you can Viguie Aleman, CMO of travel aggregator Omio, get an accurate picture of how well your highlights the importance of this: “You need to communications strategy is working. have the right data infrastructure in place and be able to adapt your predictive models.” Capture Value Plays Reassess Communications Strategy In line with attempts to optimize for immediate gains through identifying demand, apply a Previously effective communications strategies similar strategy to defend market share. Shift have likely already been undermined by the to digital channels with high availability and crisis. Work closely with public relations inventory and user stickiness, while avoiding professionals and leadership to bring a uniform high sentiment channels or those focused on and well thought out approach here. The early longer-term brand building. weeks of the crisis brought a rapid set of GRAPH 5 More Gen X and older consumers intend to return to or exceed their pre-COVID-19 spending–and to do so sooner–in the rebound period Example: Germany (trendv is consistent across markets) Spending expectation if the virus is under control in 6 months (%) For those planning to spend at levels the same as or greater than they did before the outbreak, older consumers expect to return to Higher Same Lower these levels faster. Expect to spend the same or more immediately (%) 8 Gen Z 64 and millenials Gen X 76 and older 64 For those planning to spend at lower levels than they did before the outbreak, younger consumers expect to reach this “new normal” faster. Expect spending to return to lower level or new normal within a few weeks (%) Gen Z 50 and millenials 28 Gen X 38 and older Source: BCG COVID-19 Consumer Sentiment Survey, March 27-30, 2020 (N=3,085 Germany), unweighted, representative within ±3% of Germany census demographics. Note: Question text: “If the coronavirus were to be under control in 6 months, what do you think your spending habits would be at that point in time?” and “If the coronavirus were to be under control in 6 months when do you think your spending habits would return to ‘normal’ (i.e., similar to before the outbreak)”? Data is similar for respondents who answered the same question with reference to a one-month or three-month time frame.

The Digital Imperative for CMOs | BCG Page 12 Page 14

The Digital Imperative for CMOs | BCG Page 12 Page 14